Buckle Up: The Northern Virginia housing market is wild

Plus the biggest mistakes home buyers make

Hey Everyone! Chris Colgan here with EXP Realty :-) If you want to join 15,000+ Virginia and DC home owners and never miss an update on the market, hit the subscribe button below. It only takes a second and is completely free.

February saw a temporary boom in the Northern Virginia housing market as mortgage interest rates temporarily dropped into the 5% range before shooting back up over 7%.

Closed sales in February throughout the region were up markedly from January. Fairfax County saw a 25% increase in closes, Alexandria City was up 30%, Arlington County was up 32%, Prince William County was up 8%, Fauquier County was up 4%, Stafford County was up 25%, and Loudoun County up over 42%.

Currently, inventory throughout the region is very low, with active listings in every area below their five-year average and many of the counties significantly lower.

New listings in February were down throughout the region except for Fairfax County, which is up about 5% from January. Loudoun County was down 8%, Stafford County was down 19%, Fauquier County was down 1.4%, Prince William County was down 10%, Arlington County was down 12%, and Alexandria City was down 11%.

The increase in closed sales and decrease in new listings has left the area very low on inventory. Many of the existing homes on the market have been listed for a significant amount of time as well. Average Days on Market are up throughout the region except for Fauquier County, which is right around its five-year average. Arlington and Loudoun Counties are the outliers, with their average DOM each seven days above their five-year averages.

With low inventory and uncertainty around the economy, many buyers are, at least for the time being, opting to stay on the sidelines, but as we are quickly approaching the busier summer months, we will likely see a bit more inventory soon.

Have Interest Rates Peaked?

In the past couple of weeks, there have been two events that suggest inflation may have peaked or at least be peaking, and we will soon see an end to the interest rate hikes. Earlier in March, the Bank of Canada, the counterpart to our Federal Reserve, halted their interest rate hikes after they received economic data that their inflation rate was actually on its way down.

Yes, it’s a different country, but our economies are closely intertwined, and it’s unlikely the data will significantly differ between the two for any length of time.

The other event was the failure of Silicon Valley Bank in California in mid-March. While the reasons for that failure are complex and somewhat specific to that bank, the rising rates have put many small and regional banks around the country in a very precarious situation as far as their deposits and long term assets are concerned.

There are fears that continued interest rate hikes will only exacerbate the problem, and economists from Goldman Sachs predicted that the Federal Reserve will leave rates as they are when they meet later in March.

So while it is still unknown what will happen, there is hard data to suggest we may see, at the very least, a temporary pause in the interest rate hikes, which will add some much needed stability to Northern Virginia’s housing market

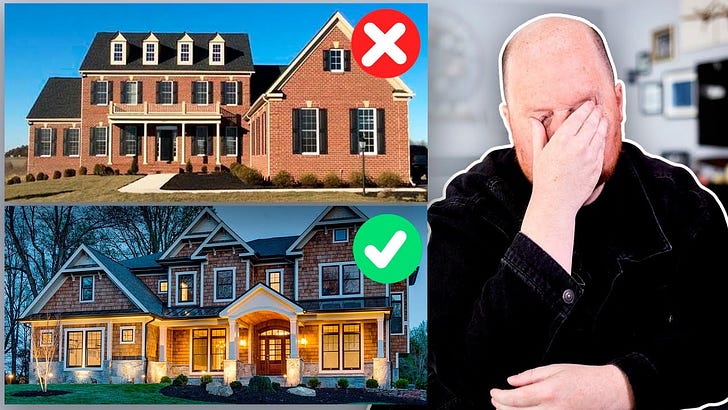

Are you looking to buy a home in Northern Virginia? If so, there are some common mistakes that you'll want to avoid. In this video, we'll go over some of the most important ones to keep in mind.

Follow Chris on Instagram! https://www.instagram.com/chriscolganteam

To search all available listings in Northern Virginia and DC area click here! 👉

Chris Colgan

EXP Realty LLC Licensed In Virginia

VA DPOR # 0225 075803

571-437-7575